Thus, any item that leads to an increase or decrease in the net income would impact the retained earnings balance. The beginning period retained earnings appear on the previous year’s balance sheet under the shareholder’s equity section. The beginning period retained earnings are thus the retained earnings of the previous year.

Free Course: Understanding Financial Statements

Retained earnings are recorded in shareholder’s equity because any profit earned by a business is the owners’ property. Retained Earnings are listed on a balance sheet under the shareholder’s equity section at the end of each accounting period. To calculate Retained Earnings, the beginning Retained Earnings balance is added to the net income or loss and then dividend payouts are subtracted. In the context of mergers and acquisitions (M&A), retained earnings take on a significant role in the valuation and structuring of deals.

Create a Free Account and Ask Any Financial Question

- Net income increases the balance in the Retained Earnings account, so we would credit the Retained Earnings account by $20,000.

- In simple words, the retained earnings metric reflects the cumulative net income of the company post-adjustments for the distribution of any dividends to shareholders.

- Consequently, any adjusting entries must be recorded to complete the effect of change.

- That’s why retained earnings are recorded in the shareholder’s equity section of a balance sheet.

Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. The retained earnings amount can also be used for share repurchases which can help improve the value of your company stock. MYOB lets you automate tedious daily tasks, provides insight into your business’s financial health, keeps you compliant with Australian tax regulations, and ultimately helps you ditch the spreadsheets. While a company often saves retained earnings to roll over into the new fiscal year, retained earnings can also be spent on reinvestments.

Retained Earnings Formula and Calculation

A maturing company may not have many options or high-return projects for which to use the surplus cash, and it may prefer handing out dividends. Profits generally refer to the money a company earns after subtracting all costs and expenses from its total revenues. It shows a business has consistently generated profits and retained a good portion of those earnings. It also indicates that a company has more funds to reinvest back into the future Bookkeeping for Veterinarians growth of the business. Yes, having high retained earnings is considered a positive sign for a company’s financial performance.

Since you’re thinking of keeping that money for reinvestment in the business, you forego a cash dividend and decide to issue a 5% stock dividend instead. First, you have to figure out the fair market value (FMV) of the shares you’re distributing. Companies will also usually normal balance issue a percentage of all their stock as a dividend (i.e. a 5% stock dividend means you’re giving away 5% of the company’s equity). Sometimes when a company wants to reward its shareholders with a dividend without giving away any cash, it issues what’s called a stock dividend. This is just a dividend payment made in shares of a company, rather than cash. In the final step of building the roll-forward schedule, the issuance of dividends to equity shareholders is subtracted to arrive at the current period’s retained earnings balance (i.e., the end of the period).

- To summarise, the total market value of the company should not change, but what should change is the per-share market value, which will decrease.

- The depreciation error was made in financial starting from Jan 1, 2018, and ending on Dec 31, 2018.

- By starting each year with zero balances, the income statement accounts will be accumulating and reporting only the company’s revenues, expenses, gains, and losses occurring during the new year.

- Sandra’s areas of focus include advising real estate agents, brokers, and investors.

How confident are you in your long term financial plan?

For newer companies looking to expand, it’s common to see higher retained earnings, since they will focus on reinvesting profit into the business. In other words, the temporary accounts are the accounts used for recording and storing a company’s revenues, expenses, gains, and losses for the current accounting year. The main difference between retained earnings and profits is that retained earnings subtract dividend payments from a company’s profit, whereas profits do not.

- Retained earnings appear on the liability side of your company’s balance sheet under shareholders’ equity and act as an important source of self-financing or internal financing.

- So, retained earnings are the profits of your business that remain after the dividend payments have been made to the shareholders since its inception.

- Next, add the net profit or subtract the net loss incurred during the current period, which is 2023.

- Revenue increases and decreases will impact retained earnings because they affect profits and net income.

- GAAP specifically prohibits this practice and requires that any appropriations of RE appear as part of stockholders’ equity.

- These funds can be used for anything the business chooses, including research and development, buying new equipment, or anything else that will lead to growth for the company.

Losses to the Company

- Corporations, being separate legal entities from their owners, have a more complex structure for handling retained earnings.

- In other words, the temporary accounts are the accounts used for recording and storing a company’s revenues, expenses, gains, and losses for the current accounting year.

- Retained earnings are considered an important concept concerning a company’s financial statements.

- When a prior period adjustment is used, it appears as a correction of the beginning balance of RE and is fully described.

- Most commonly, the statement of retained earnings record beginning year balance, net income, any dividends declared or paid out.

It’s a measure of the resources your small business has at its disposal to fund day-to-day operations. Many companies consider dividend payouts and plan investment strategies at year end. We can help determine what’s appropriate for your situation and answer any lingering questions you might have about your business’s statement of retained earnings. The process of calculating a company’s retained earnings in the current period initially starts with determining the prior period’s retained earnings balance (i.e., the beginning of the period).

Retained Earnings vs. Net Income: What is the Difference?

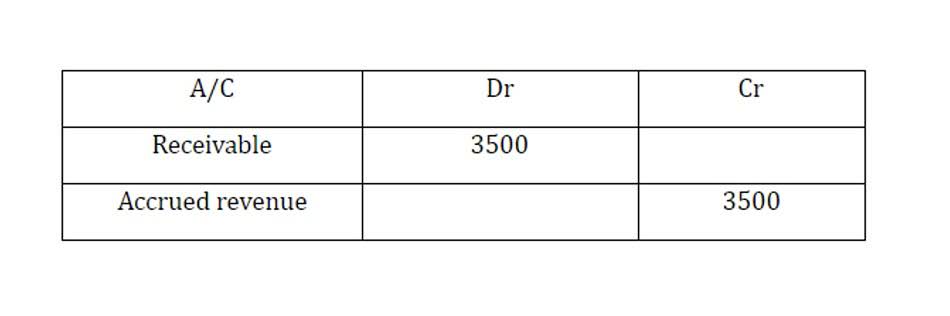

So for example there are contra expense accounts such as purchase returns, contra revenue accounts such as sales returns and contra asset accounts such as accumulated depreciation. For this reason the account balance for items on the left hand side of the equation is normally a debit and the account balance for items retained earnings natural balance on the right side of the equation is normally a credit. Net income increases the balance in the Retained Earnings account, so we would credit the Retained Earnings account by $20,000. A (relatively) painless rundown of the double-entry system of accounting, and why your business should probably switch to it immediately. Up-to-date financial reporting helps you keep an eye on your business’s financial health so you can identify cash flow issues before they become a problem. We’ll pair you with a bookkeeper to calculate your retained earnings for you so you’ll always be able to see where you’re at.

Step 1: Prepare the Statement Heading

As the company loses ownership of its liquid assets in the form of cash dividends, it reduces the company’s asset value on the balance sheet, thereby impacting RE. The period beginning retained earnings is a cumulative balance of all the retained earnings from prior periods. The net income or loss relates to the current year’s operations and corresponds to the net income of loss of the company. Cash dividends are paid to the shareholders, and stock dividends are bonus shares issued to the shareholders.

Leave a comment